annuity inheritance tax pennsylvania

For over two decades the elder care professionals at Rothkoff Law Group have been helping clients and their families respond to the legal financial physical and. The general answer is yes the annuity is subject to the PA Inheritance Tax and the tax is calculated on the Fair Market Value of the contract on the date.

Pennsylvania Trust Guide Includes Book Digital Download Bisel Publishing

And you have the same amount of.

. If you are doing this yourself you can find the. Pennsylvania Inheritance Tax On Annuity Payments. When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account.

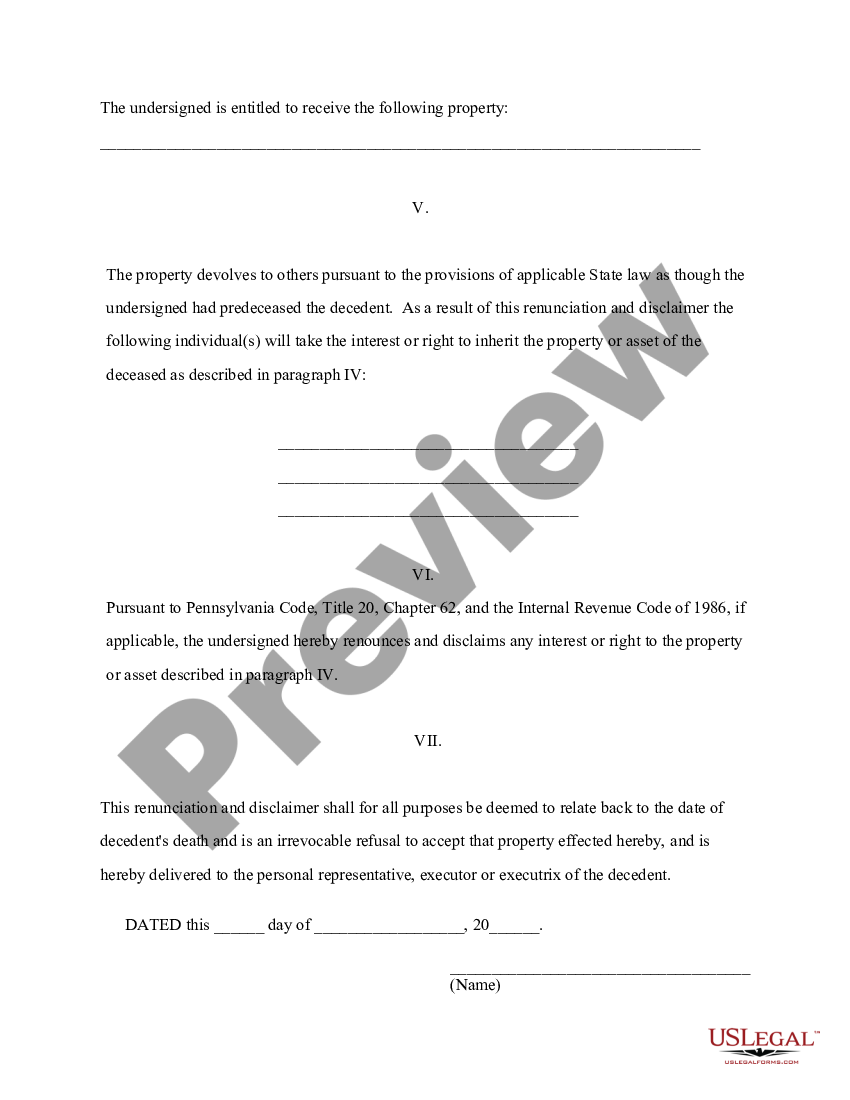

How taxes are paid on an. The Pennsylvania inheritance tax is technically a tax on the beneficiarys right to receive your property. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is.

The medium of the Transfer Inheritance Tax by continuously and progressively widening the scope of its embrasure is demonstrated clearly by a short historical survey of various statutes. The amount of tax a beneficiary pays depends on the value of the property they. Posted on Dec 10 2013.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. An annuity contained in a retirement account may be exempt from Pennsylvania Inheritance Tax as life insurance under certain circumstances. Posted on Jan 7 2021.

Non-investing personal finance issues including insurance credit real estate taxes employment and legal issues such. You could opt to take any money remaining in an inherited annuity in one lump sum. These payments are not tax-free however.

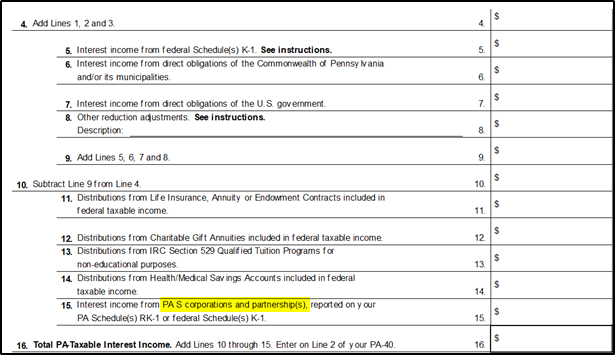

There are very few items which are not taxable by the Pennsylvania Inheritance Tax. Section 2111d of the. If the annuities represent a return on an investment a single premium was paid they are taxable and should be reported on REV-1510 Schedule G of the REV-1500 Inheritance.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. The tax rate varies. Youd have to pay any taxes due on the benefits at the time you receive them.

Non Qualified Annuity Tax Rules Immediateannuities Com

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Fill Free Fillable Forms For The State Of Pennsylvania

Tax Allocation Clause Protect Your Beneficiary S Elder Law Pennsylvania

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Do I Have To Pay Pa Inheritance Tax On Annuity Iras Legal Answers Avvo

Delaware Life Pinnacle 7 Myga Annuity 3 70 Rate

Inheritance Tax Return Resident Decedent Rev 1500 Pdf Fpdf Doc Docx Pennsylvania

Pennsylvania Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract Pa Renunciation Form Us Legal Forms

Do I Pay Taxes In Pennsylvania When Someone Leaves Me Money

What Is An Annuity Rates Types Pros Cons

Settling An Estate In Pennsylvania

How To Pay Inheritance Tax With Pictures Wikihow Life

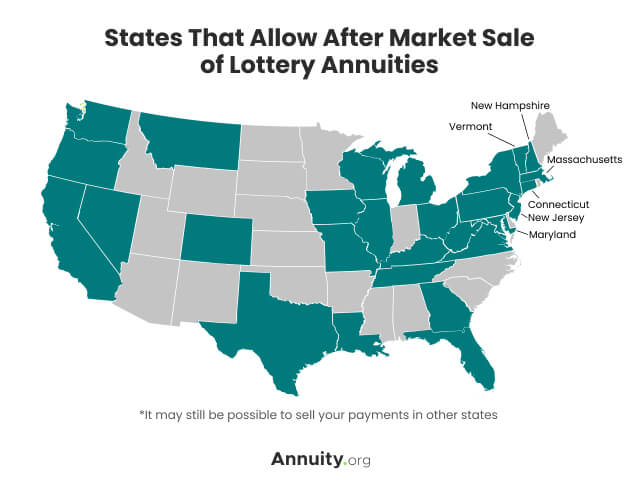

Lottery Payout Options Annuity Vs Lump Sum

Annuity Beneficiaries Inheriting An Annuity After Death

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out